Pension – Auto Enrolment Ireland

Introducing Auto – Enrolment

January 2026

Auto – Enrolment Ireland is a pension investment scheme for employees, automatically enrolling eligible employees into a retirement saving scheme. This scheme involves employer to match employee contribution with a top – up from State funds. The accumulated pension funds will be paid to participants upon their retirement in addition to the State pension. Drawdown will be linked to the State pension age.

Pension Act 2024 Key Elements:

- Employees aged 23 to 60 earning over €20,000 per annum who are not already included in pension scheme will be automatically enrolled

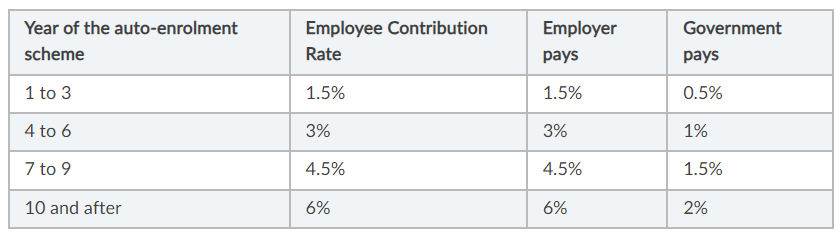

- Starting at 1.5% of gross earnings in 2025, contributions will gradually increase every 3 years to a maximum of 6% in 20234

- Employees have the option to opt out after a mandatory 6 months participation period they will be re – enrolled again after 2 years

An estimated 750,000 employees earning more than €20,000 per annum, aged between 23 and 60, who are not already enrolled in a occupational pension scheme, will be automatically enrolled.

Employer / Employee Contributions

- Initial contributions will start at 1.5% of gross income (for both employee and employer)

- This amount will be increased on a phased basis (ever 10 years) until a total of 6% is achieved (for both employee and employer)

- Employer will match employee contribution and State will top – up employee contribution by 33%

- Employer and State contributions are capped at €80,000 gross annual salary

However, if you earn more than €80,000 you can contribute more but your employer and State will not contribute in excess of this €80,000 cap.

For every €1 contributed by an employee, employer will match €1 and State will provide top-up €0.33.

For each €1 saved by an employee – €2.33 will be credited into their pension account (€1 from employer + €0.33 from State).

Auto - Enrolment Included In Our Payroll Services

MPAS Payroll acts as Revenue agent for Employer PAYE. We take the hassle out of payroll processing by doing the heavy lifting – registering employer with Revenue, filling employer Revenue returns, setting up of new employees, obtaining new tax information for employees, etc.

Auto – Enrolment and State Pension

No changes to the State pension as of now.

An employee’s PRSI payments will remain in place towards State pension

The aim of auto – enrolment is to provide some extra income for employees who do not have already private pension in place.

As with any pension plan, funds will be invested in a mixture of stocks, government bonds, commodities, etc. through managed funds. It is expected that choice of managed funds with various levels of investment risks/returns will be available.

Already In Workplace Pension

Employees already enrolled in workplace pension will not be enrolled in the new auto – enrolment scheme.

Changing Job/Employer After Being Auto – Enrolled

The scheme will be set up on “scheme follows the employee” basis. Employee will not have to join a new scheme every time they change their employer as auto – enrolment scheme will follow their employment.

Participants of the new auto – enrolment scheme will be able to access their pension via an online account.

If you have an occupational pension scheme (pension provided by your employer), your pension will work differently. Under the auto-enrolment scheme, there is no tax relief, but the State tops up employee contribution by 33%.

An employee with a private pension receives tax relief. The rate of tax relief is set at the highest rate of income tax the employee pays.

Under the auto – enrolment scheme, there is no tax relief, but the State tops up the contribution by 33%.

Self – Employed and Auto – Enrolment

Auto – Enrolment is for PAYE workers only. If you are self-employed your existing pension options remain unchanged.

Prepare for the new legislation

MPAS Payroll, Your outsourced Payroll Provider

MPAS Payroll is outsourced payroll provider, serving any size or industry organisations throughout Ireland. We provide Payroll Services regardless of your location. Contact us for your payroll quote.